How To Start Out A Business With Only Gold ETFs

페이지 정보

본문

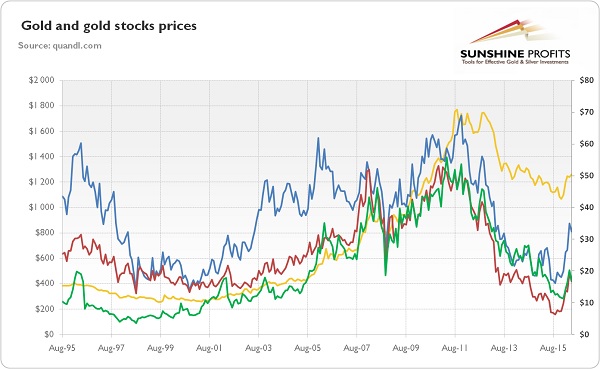

Item: A while in the past I received within the mail a brochure suggesting that I purchase as an investment a set of Choice Brilliant Uncirculated (BU) Roosevelt Silver dimes. This is the chance that your broker is unable to settle the CFD when the time comes, which seemingly means your broker has gone bankrupt, which is rare but not not possible. Investing in equities means proudly owning a bit of a enterprise. As a safe-haven asset, proudly owning gold works relatively effectively in times of mild damaging market volatility. With curiosity charge cuts looming and the stock market trading near all-time highs, some investors are looking for a protected asset that has a proven track document of good points - and that’s gold. 2023 and the anticipated end of aggressive price hikes by the Fed. The at the moment starting section from the tip of July to the start of October can be reflected in the purple line depicting the seasonal pattern of gold stocks - their prices are rising as properly (arrow in the midst of the chart). Yes, throughout durations of comparatively minor volatility, buyers will bid up gold by buying it as a secure haven.

First, ensure to choose an organization that will can help you put money into valuable metals different than simply gold. The gold bullion market is international. This is the facet of the platinum spot value that the bullion supplier will consider when purchasing platinum bullion back from the retail public. StoneX Bullion also stocks bullion bars in gold, silver, platinum and palladium. The most important metro space, Indianapolis, is residence to many nice coin outlets and bullion sellers. Are There Taxes on Buying Gold and Silver Bullion in Indiana? In the charts under, we are able to see that both gold and the U.S. Depending on current market volatility, gold can rise along with inflation, but may additionally decline as curiosity charge hikes to struggle inflation are enacted. Most gold trading takes place on the over-the-counter (OTC) market, which is available on most buying and selling platforms as a CFD. No alternate of physical gold takes place when shopping for gold by means of a CFD.

The contracts are standardized by a futures alternate as to the amount, high quality, time, and place of supply. A gold futures contract, alternatively, is a legally binding agreement for the delivery of gold in the future at an agreed-upon worth. Gold is most simply traded as a CFD on most broker-based electronic buying and selling platforms, however can be traded using gold futures and gold ETFs. Can the worth of gold ever rise to $10,000? However, the connection is tentative at greatest as seen under with the patron Price Index (CPI) rising rapidly in 2021-22, and gold declining throughout that period. Invesco India Gold Fund is probably the greatest mutual funds, acceptable for investors seeking regular returns and lengthy-time period capital progress. A purchase may require more or less gold, relying on demand, however gold is usually acceptable. Rather, after a spot gold place is opened by means of the acquisition of a CFD, once it is closed (bought), your broker settles the trade in U.S. Is Gold a Safe-Haven Asset? Alternatively, if markets are in excessive turmoil, and stocks and commodities are each collapsing, then gold may get sucked into the general commodity market collapse and not offer safe-haven status.

The contracts are standardized by a futures alternate as to the amount, high quality, time, and place of supply. A gold futures contract, alternatively, is a legally binding agreement for the delivery of gold in the future at an agreed-upon worth. Gold is most simply traded as a CFD on most broker-based electronic buying and selling platforms, however can be traded using gold futures and gold ETFs. Can the worth of gold ever rise to $10,000? However, the connection is tentative at greatest as seen under with the patron Price Index (CPI) rising rapidly in 2021-22, and gold declining throughout that period. Invesco India Gold Fund is probably the greatest mutual funds, acceptable for investors seeking regular returns and lengthy-time period capital progress. A purchase may require more or less gold, relying on demand, however gold is usually acceptable. Rather, after a spot gold place is opened by means of the acquisition of a CFD, once it is closed (bought), your broker settles the trade in U.S. Is Gold a Safe-Haven Asset? Alternatively, if markets are in excessive turmoil, and stocks and commodities are each collapsing, then gold may get sucked into the general commodity market collapse and not offer safe-haven status.

Stocks of gold miners or associated companies provide shares, however they do not characterize any form of gold ownership. Investors like gold for a lot of causes, and it has attributes that make the commodity an excellent counterpoint to conventional securities comparable to stocks and bonds. Gold is a preferred option for a lot of buyers for several reasons. As well as, it’s illegal for investors to pay themselves or a company they personal for making improvements to an funding property bought with their own SD-IRA funds. But throughout periods of excessive turmoil, where traders are promoting all the things from stocks to commodities, gold can get caught up in the volatility and be sold alongside different commodities, negating its protected-haven standing. After you have settled on a treasured metals IRA provider, chosen a custodian and funded your account, you possibly can select the kind and quantity of metals you want to spend money on. If you’re invested in a broad range of commodities together with gold-say, a broad-based mostly commodity ETF-and you've got a better risk tolerance, then the general allocation might be 5% to 10% of your whole portfolio. When it comes to portfolio allocation, gold ought to be a minor technique of diversification-usually talking, not more than 5% of a complete portfolio.

Stocks of gold miners or associated companies provide shares, however they do not characterize any form of gold ownership. Investors like gold for a lot of causes, and it has attributes that make the commodity an excellent counterpoint to conventional securities comparable to stocks and bonds. Gold is a preferred option for a lot of buyers for several reasons. As well as, it’s illegal for investors to pay themselves or a company they personal for making improvements to an funding property bought with their own SD-IRA funds. But throughout periods of excessive turmoil, where traders are promoting all the things from stocks to commodities, gold can get caught up in the volatility and be sold alongside different commodities, negating its protected-haven standing. After you have settled on a treasured metals IRA provider, chosen a custodian and funded your account, you possibly can select the kind and quantity of metals you want to spend money on. If you’re invested in a broad range of commodities together with gold-say, a broad-based mostly commodity ETF-and you've got a better risk tolerance, then the general allocation might be 5% to 10% of your whole portfolio. When it comes to portfolio allocation, gold ought to be a minor technique of diversification-usually talking, not more than 5% of a complete portfolio.

If you have any issues pertaining to where and how to use سعر الذهب في تركيا, you can contact us at our web site.

- 이전글วิธีการเริ่มต้นทดลองเล่น Co168 ฟรี 24.12.04

- 다음글Top Features to Look for in Online Cam Chat Platforms 24.12.04

댓글목록

등록된 댓글이 없습니다.